Overview

Selling products online is subject to various types of taxes that can differ based on factors such as inventory location, shipping addresses, and, of course, the nature of the product. For certain stores, particularly those operating in a B2B model, tax calculations can become intricate and require an external tax calculation provider.

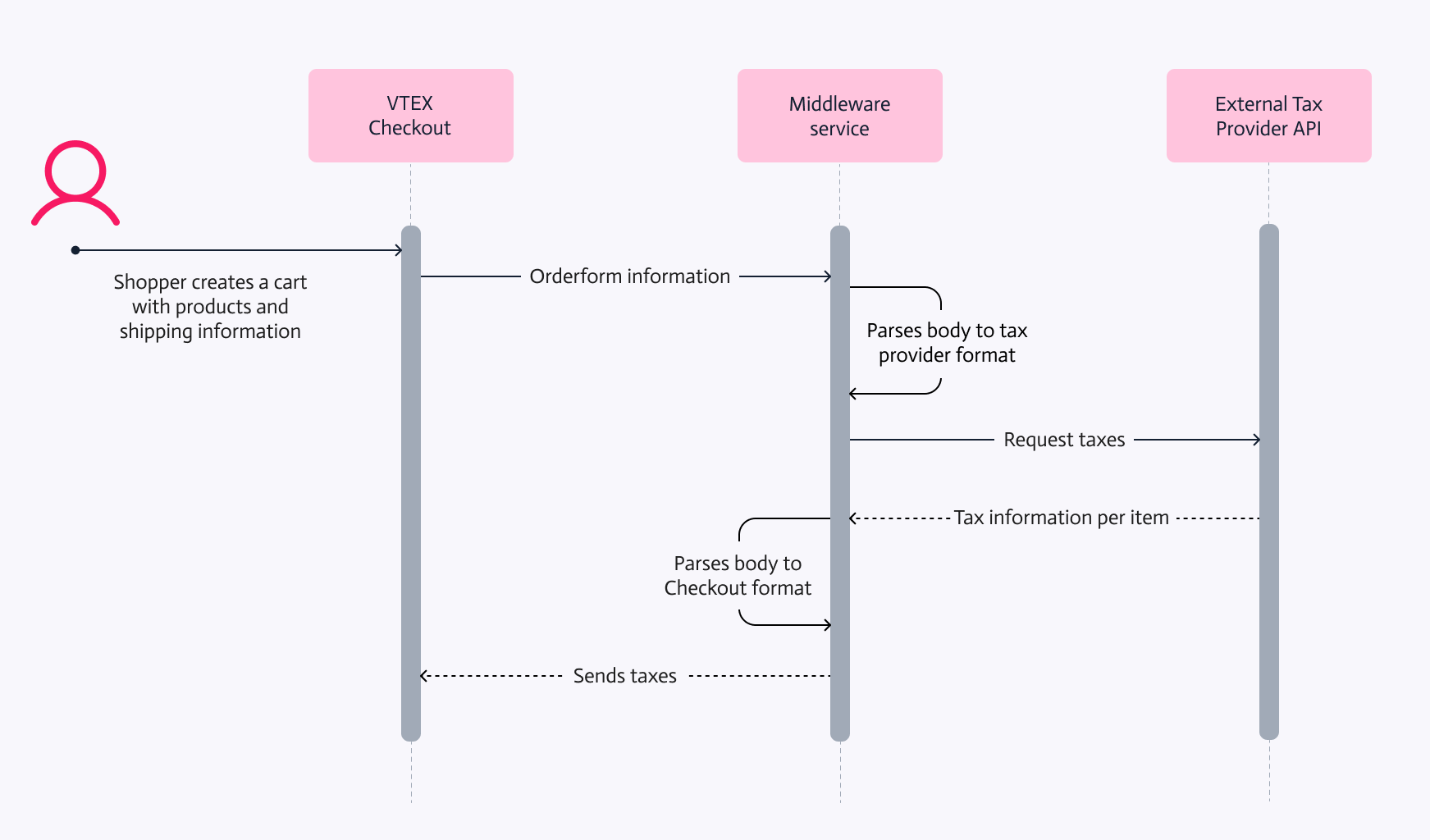

In such scenarios, it is possible to establish an integration that enables a store to send checkout information to an external tax calculation API and obtain a response from that API with the necessary tax details and values applicable to the purchase.

Implementation

Access the specification and recipe to learn more about Tax Service integration and how to implement it.