The specified version of the app (0.x.0) does not exist. This page is about the latest stable version, which is 0.6.3.

The TaxJar app uses the TaxJar API to calculate taxes. Optionally, invoiced orders will be recorded in TaxJar for reporting.

Configuration

Step 1 - Create API Token in TaxJar

Step 2 - Install the TaxJar app

Using your terminal, log in to the desired VTEX account and run the following command:

vtex install vtex.taxjar

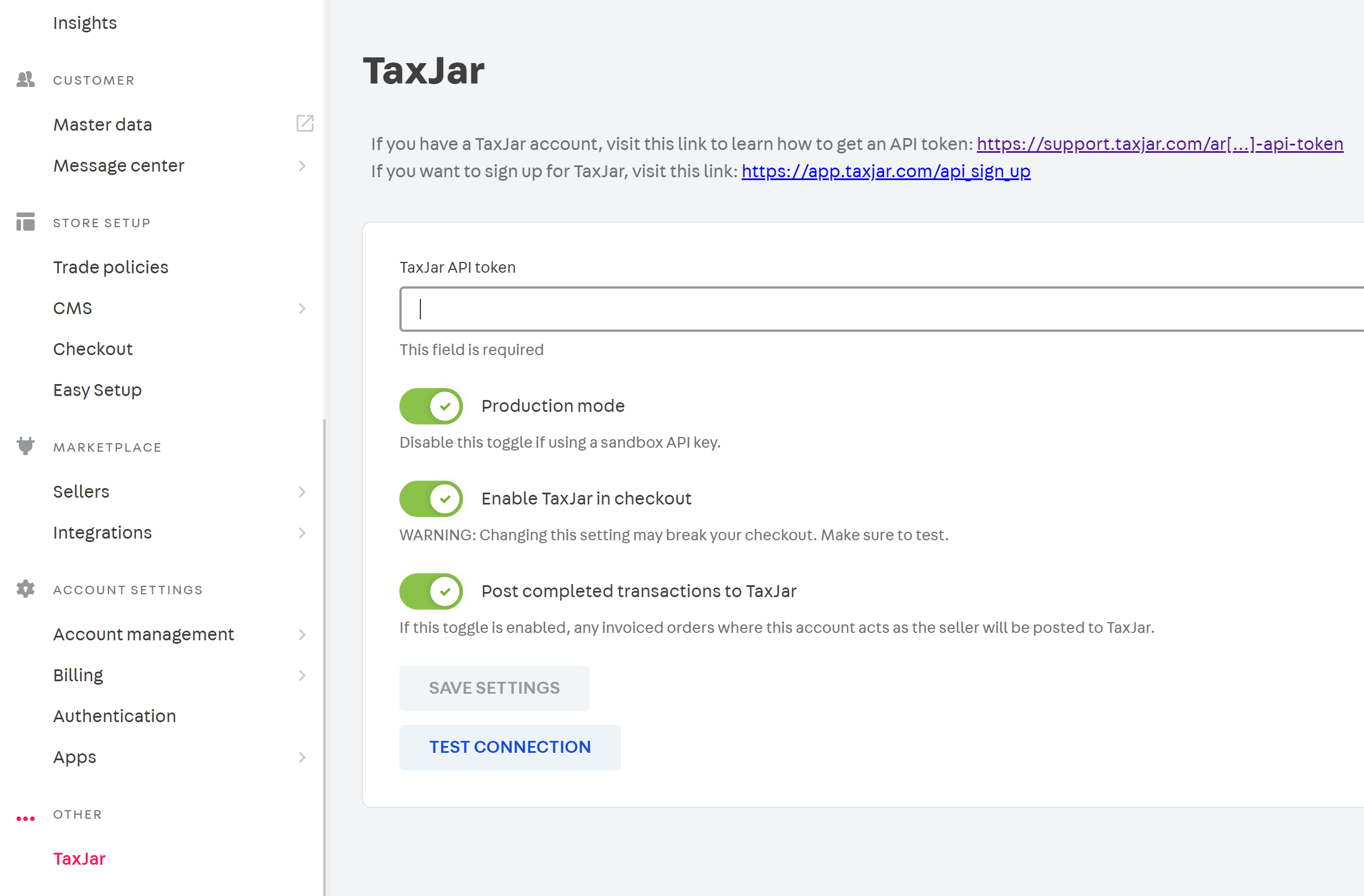

Step 3 - Defining the app settings

- Enter the API Token.

- Choose optional settings

- Production Mode - The entered API Token is a Live token.

- Enable TaxJar inb checkout - Request tax calculations.

- Post completed transactions to TaxJar - Record invoiced orders in TaxJar

- Post marketplace transactions to TaxJar - Record invoiced marketplace orders in TaxJar

- Save Settings.

- Test Connection.

Step 4 - Adding customer exemptions

- Fill in all fields, making sure that the email used is a valid VTEX account.

- Currently, the application supports up to three exempt US states for a user.

Notes

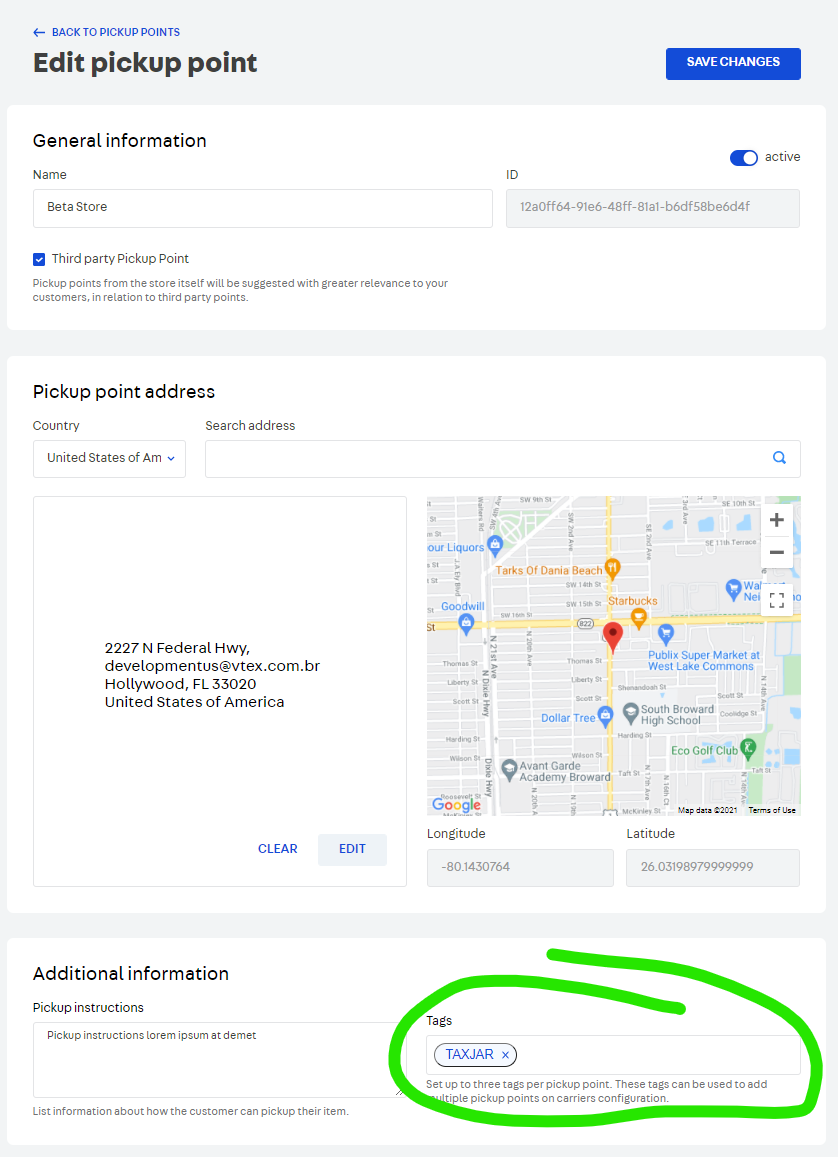

- Pickup points are used to determine nexus addresses. Must be tagged with 'TaxJar'

- Product tax codes are entered in Catalog -> Products and SKUs -> Tax Code.

- An order transaction is created in TaxJar when an order is invoiced.